A thorough study by the Home Media assesses group located that the companies with the most inexpensive cars and truck insurance rates on average in 2022 are USAA, Erie Insurance, State Ranch, Geico and Progressive. cheaper. Simply because you're needed to have auto insurance does not mean you need to pay a great deal to get it (accident).

The complying with carriers stand out from the competition as the ideal cheap car insurance policy carriers not just for the discounts they use but also for their client service and solid market credibilities (laws). # 1 USAA: Affordable for Army Families If you're an armed forces member, professional or participant of an army household, you could find the most affordable vehicle insurance via USAA. cheap car.

cheaper liability credit car insured

cheaper liability credit car insured

Along with having cost effective plans, USAA is one of one of the most reliable providers in the industry and earns several of the greatest customer fulfillment ratings. Below are a few other things we such as concerning USAA: Find out more # 2 Erie Insurance: Budget Friendly for Fundamental Insurance coverage Our analysis shows Erie Insurance policy is one of the most inexpensive insurance policy service providers for several types of drivers.

low cost auto auto low cost low-cost auto insurance

low cost auto auto low cost low-cost auto insurance

accident cheap affordable auto insurance cheap auto insurance

accident cheap affordable auto insurance cheap auto insurance

The Erie Price Lock program permits eligible consumers to prevent the costs enhances that happen over the course of a few years (laws). In this program, there are just three reasons insurance policy holders could see their prices enhance: including or removing a lorry, adding or removing a person from the plan or transforming addresses. laws.

The Best Strategy To Use For How To Reduce Uber Insurance Cost - Marylandreporter.com

If you fit this summary, auto insurance from Erie can typically be very affordable - cars. Below are a few more factors we recommend Erie: A+ financial toughness rating from AM Finest A+ rating from the BBB First place in the North Central region as well as second location in the Southeast and Mid-Atlantic areas the J.D. suvs.

Read extra # 3 State Ranch: Cost Effective for Pupils State Ranch can be another fantastic choice when you're searching for the cheapest automobile insurance coverage. Considering that its founding in 1922, State Farm has expanded to come to be the biggest insurance company in the U (vehicle).S. affordable car insurance. The company has a robust national network of neighborhood representatives, so there's likely a representative in your location who can assist you.

vehicle cheaper car cheap car insurance business insurance

vehicle cheaper car cheap car insurance business insurance

At that scale, State Farm can offer a range of insurance coverage levels to satisfy most chauffeurs. We ranked State Farm 9. The company supplies rideshare insurance coverage, roadside assistance, accident forgiveness and more.

cheap car insurance vehicle insurance credit laws

cheap car insurance vehicle insurance credit laws

Geico's noteworthy price cuts include 25% financial savings for insuring multiple lorries as well as Browse around this site a 15% trainee price cut. cheap auto insurance. Right here are a couple of even more points we such as regarding Geico: A++ economic stamina score from AM Best 3rd location for New England and fourth area for The golden state in the J.D. Power Automobile Insurance Policy Research 78% client contentment rate amongst its insurance holders in our 2022 automobile insurance policy study Choices for mechanical breakdown insurance coverage as well as usage-based insurance coverage Extremely ranked mobile application Find out more # 5 Progressive: Budget-friendly for High-Risk Drivers As the nation's third-largest car insurance provider, Progressive covers countless vehicles annually as well as can be one of the most inexpensive options for insurance coverage.

What Does Rentalcars.com: Cheap Car Hire, Best Rental Prices Do?

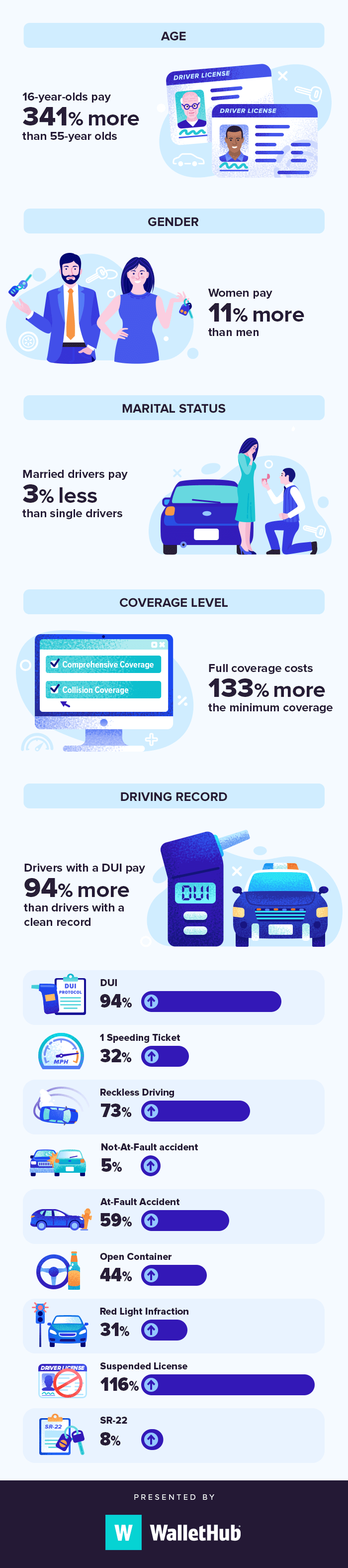

Nearly 37% stated they would get complete protection with low limits, while just over 30% reported they would acquire full protection insurance coverage with high restrictions - trucks. If you finance your automobile, your lending institution will likely require you to carry full coverage until your car car loan is paid off. Below are a few of the main sorts of auto insurance coverage and also their needs: Elements that can impact your automobile insurance coverage prices It's important to keep in mind that auto insurance prices are greatly individualized, as insurer take many aspects right into account when determining what you should pay for a policy.

However, some states have less costly car insurance coverage than others. Below are the 5 least pricey states for full protection car insurance: And below are the top five most expensive states for full protection vehicle insurance policy: Cheapest car insurance policy by state In some states, small, regional business supply the least expensive vehicle insurance (cheaper car).

One company that might be expensive in Nevada may supply some of the most affordable rates offered in Pennsylvania. While USAA is commonly the cheapest provider in a lot of states, it's not offered to every person as a result of eligibility requirements. Below is our full checklist of the companies that often tend to be the cheapest insurance companies in every state: State typical prices can only tell you so a lot.

The provider that's generally the most inexpensive auto insurer in a state might not be the most inexpensive in every zip code. Most affordable auto insurance for chauffeurs with a current mishap Not everybody has the ideal driving background and circumstance to get the most affordable rates. Below, you can see some popular carriers' ordinary full protection car insurance coverage prices for chauffeurs with a current crash: Cheapest auto insurance after a drunk driving Getting founded guilty of a DUI will certainly result in a significant boost in automobile insurance coverage prices. cheaper car insurance.

The Main Principles Of 5 Cheapest Car Insurance Companies In The U.s. (2022)

This number varies in different regions of the nation and also among carriers. auto. Below are the most inexpensive monthly cars and truck insurance prices for chauffeurs that have actually had one DUI contrasted to prices for those without a DRUNK DRIVING: Cheapest car insurance policy for vehicle drivers with poor credit Factors beyond your driving record can influence your cars and truck insurance costs. insurance.

While a credit-based score consists of the exact same aspects as a normal credit history score, consisting of repayment background and also financial debt, the 2 ratings consider these variables in different ways. Insurance companies aren't permitted to use credit history to aid figure out automobile insurance coverage prices in The golden state, Hawaii, Massachusetts and Michigan (these states were left out from this component of our analysis).

as well as those with lapses in automobile insurance. Until you have an even more established driving record, it might be less expensive for you to remain on a member of the family's auto insurance plan at first. After that, contrast prices from companies when your plan is up for revival. car insurance. On average, teenagers and young people pay the most for cars and truck insurance coverage.